Santander Ultimate Cash Back Credit Card | Santander Bank - Santander

Rewards

- 0% Introductory APR on all qualified purchases for 15 months* to ensure you’re always spending smarter

- 0% Introductory APR on Balance Transfers made within 90 days of account opening for the first 15 months* to help you take control of your finances

- After 15 months, the variable APR on purchases and Balance Transfers will be 18.24%– 27.36%.* The Balance Transfer fee is the greater of 5% of the amount transferred or $10.

- 3% cash back on qualified purchases for the first 12 months, up to $20,000 – then an unlimited 1.5% cash back on qualified purchases afterward – so you earn more with every purchase

- No annual fee so your money stays where it belongs — with you

Control

- The flexibility you want to make payments at different points within your billing cycle❘❘

- The convenience you need to easily activate your card, manage your account, and set alerts from our highly-rated Mobile Banking App

- Effortless on-the-go-spending when you add your card to Apple Pay or Google Pay

- Cash back direct to your account so your 3% cash back earnings drops straight into your Santander checking or savings account – keeping you fully in control of your money

Security

- Zero fraud liability so you’re not responsible for fraudulent transactions (policy subject to terms and conditions for your card or account)¶

- Santander® Instant Card Hold helps keep your account safe by instantly putting lost or stolen cards on hold†

- Santander ProTECHtion helps safeguard your information in Mobile and Online Banking with biometric security, including facial or fingerprint recognition

Everyday convenience

Digital Security & Fraud Protection Features:

- Santander® Instant Card Hold†

- Account activity alerts

- Zero fraud liability policy¶

Activate your card, manage your account, and set alerts all from our highly-rated Mobile Banking App.

You can also make purchases with chip-enabled contactless payments, connect with Apple Pay, Google Pay, or Samsung Pay for instant purchases, or schedule bill payments with Online Bill Pay.

Declutter and save on fees by accessing all your statements electronically instead of receiving them by mail.

Bank anywhere, anytime

Manage your account whenever and wherever you want with our Mobile Banking App.

Download our

Mobile Banking App

Unlock on-the-go features with our highly-rated Mobile Banking App.

Scan QR code to open app. ![]()

Enroll in Santander

Online Banking

Manage your money securely by enrolling in Online Banking.

FAQs: Credit Card

There are no restrictions on where you can earn cash back on new purchases.‡

Just login to your online banking and follow these step-by-step instructions.

You can choose what is most convenient for you. You can redeem your cash back rewards via statement

credit, or gift cards.‡

No annual fees*

No foreign transaction fees.*

Yes, you can request a balance transfer after you’ve been approved and received your card. There is a 0% introductory annual percentage rate (APR) for 15 billing cycles on balance transfers made within 90 days of account opening. After that your variable APR on balance transfers will be 18.24%—27.36% APR.* The Balance Transfer fee is the greater of 5% of the amount transferred or $10.‡

Look for this symbol at checkout and simply hold your card or digital wallet to the payment terminal for

quick, secure, and safe hands-free checkout.

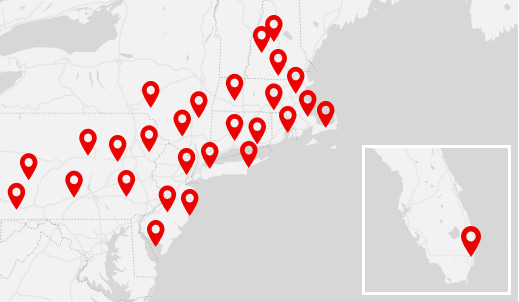

Find

Us

Find

Us

Download or review your

Card Agreement

*0% Introductory Annual Percentage Rate (APR) for 15 billing cycles on Balance Transfers made within 90 days of opening your account and 0% introductory APR for 15 billing cycles on Purchases. After the introductory period, a variable APR for Balance Transfers from 18.24%–27.36% based on the Prime Rate and your creditworthiness. After the introductory period, a variable APR for purchases from 18.24%–27.36% based on the Prime Rate and your creditworthiness. Cash advance APR of 28.89%. Rates effective as of 01/02/2026. Rates are subject to change and may vary based on the Prime Rate in effect on the date of application. The Balance Transfer Fee is the greater of 5% of the amount transferred or $10. The Cash Advance Fee is the greater of 5% of the amount of the cash advance or $10. There is no grace period on Balance Transfers because interest accrues from the date of the transaction. This means that, unless your purchase APR is at an introductory or promotional 0% APR, you will pay interest on new purchases from the date made if you do not pay all balances, including the promotional Balance Transfer, in full by the payment due date appearing on your statement. Balance Transfers may not be used to pay off or pay down any account issued by Santander Bank, N.A. Balance Transfers must be payable to another institution’s credit card balances that accept our electronic payments. Loss of any introductory or promotional rate, if any, may apply indefinitely to your account if you miss or make a late payment or otherwise default. There are no Annual or Foreign Transaction Fees. Finance charges still apply. Each time we do not receive the Minimum Payment Due in full by the Payment Due Date, we will charge you a Late Fee of $29 for the first late fee in a 6-month period and a $40 fee for each late payment until there are 6 consecutive months with no late payments. However, we will never charge a Late Payment Fee exceeding the Minimum Payment Due that is late. For the first 12 months after account opening, you earn 3% cash back on new net retail purchases (qualifying purchases less credits, returns, and adjustments) until you have spent $20,000 USD or equivalent. Otherwise, you earn 1.5% cash back on new net retail purchases. Cash back can be redeemed for statement credit, gift cards, or electronic certificates. Cash back cannot be earned on Balance Transfers, cash advances, purchases of money orders and other cash equivalents, purchases made by or for a business purpose, fees, interest charges, unauthorized/fraudulent transactions, and certain other charges. Cash back balance does not expire for accounts in good standing. Other terms and conditions apply. Credit card accounts are subject to approval.

†Santander® Instant Card Hold will block most types of transactions, including purchases made with your card. Please note that some types of transactions will continue to process, including recurring debit/credit transactions presented to us by certain merchants for monthly membership or subscription fees.

§Rating by Apple App Store customers 4.8 out of 5 Rating. Based on 400k ratings on the app store as of 12/16/2025.

¶Additional terms apply and unauthorized transactions must be promptly reported. See “Unauthorized Use of Your Card or Account” within the Santander Ultimate Cash Back Credit Card Agreement for details.

Apple, the Apple logo, Apple Pay and Touch are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc., registered in the U.S. and other countries.

Google Pay is a trademark of Google LLC, Android, Google Play, and the Google Logo are trademarks of Google LLC.

2024 Samsung Pay is a trademark of Samsung Electronics Co. Ltd. use only in accordance with law.

Santander Bank, N.A. is a Member FDIC and a wholly owned subsidiary of Banco Santander, S.A. © Santander Bank, N.A. All rights reserved. Santander, Santander Bank, the Flame Logo and Ultimate Cash Back, Bravo, and Sphere are trademarks of Banco Santander, S.A. or its subsidiaries in the United States or other countries. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. All other trademarks are the property of their respective owners.

Equal Housing Lender - Member FDIC

Equal Housing Lender - Member FDIC