Santander Select Checking Account | Santander Bank - Santander

Santander

Select® Checking

Account details

An interest-bearing checking account with enhanced benefits and discounts.

Monthly Fee

combined balance of $25,000*

Minimum balance

Debit card† and ATM fees‡

- No fee to use your Santander Select® World Debit Mastercard® at more than 30,000 Santander ATMs globally

- Get up to $30 rebated per service fee period for ATM surcharge fees charged by other institutions at non-Santander ATMs

- No international transaction fee for debit card purchases and ATM withdrawals

Account opening deposit

Interest

Statement delivery options

- $0 for paperless statements

- $0 per paper statements

Get expert advice from our team of financial specialists in business and investments§. Plus, you get priority servicing when you call the Santander Select® Services Line at 855-678-2265.

International Debit Card transactions, incoming wire transfers, and more.

Get premium rates when you open a Santander Select® Money Market Savings account.

- Enjoy Travel Protection for cancelled or delayed trips and lost or delayed luggage1.

- Access exclusive tickets and reservations with Mastercard Concierge Services.

- Travel in comfort with a complimentary annual membership to Priority Pass2.

- Shop confidently with Zero Liability3 for unauthorized purchases, Extended Warranty, Purchase Assurance, and Satisfaction Guarantee.

- For assistance with your Santander® Select World Debit Mastercard benefits, please call 866-214-5084.

Convenience in the palm of your hand

Flexibility when you need it most

The trust you need to bank confidently

Advantages of your World Debit Mastercard®

A Debit Mastercard® deducts money directly from your checking account. You can use it to withdraw cash and shop anywhere Mastercard is accepted.

Deposit with Mobile Check Deposit

Just take a picture of your signed check while you’re on the go.

Santander Safety Net

Extra leeway goes a long way. Santander Safety Net waives overdraft fees for accounts overdrawn by $100 or less.¶¶

Secure biometric authentication

Only you can unlock your information with Touch ID® and Face ID® for Apple and fingerprint for Android††.

Just tap and go

Conveniently make fast purchases with contactless payments. Just insert your card, swipe, or tap and go.

Manage your account

Pay bills, send money with Zelle®**, make transfers, and more, all from the Mobile Banking App.

Lower and fewer overdraft fees§§

We’ve lowered our overdraft fees from $35 to $15 and we’ve eliminated the Item Returned Fee. You won't be charged a Paid Item Fee more than 3 times per Business Day.

Digital Banking Guarantee‡‡

Shop online, in-store, or make bill payments with Santander PROTECHTION by your side.

Shop online, in-store, or make bill payments with Santander PROTECHTION by your side.

Create or update your PIN, update contact information, and report a lost or stolen card.

You won’t be charged Overdraft Protection Transfer Fees, so you can cover any overdrafts that happen before a fee gets assessed.

For digital security, our firewalls protect all your information stored in our database.

Access to Santander ATMs globally

Use your card at more than 30,000 Santander ATMs globally with no fee.

Bank anywhere, anytime

Manage your account whenever and wherever you want with our Mobile Banking App.

Download our

Mobile Banking App

Unlock on-the-go features with our highly-rated Mobile Banking App.

Enroll in Santander

Online Banking

Manage your money securely by enrolling in Online Banking.

FAQs: Checking

To open an account in a branch, you will need two forms of Identification, including a Primary ID — which is a valid, government-issued photo ID (Driver’s License, Passport, State or Military ID), AND a Secondary ID — some examples include bank-issued ATM or debit cards, major credit cards, utility bills and birth certificates. You’ll also need your Social Security Number (Non-Residents can still apply without a SSN or can use their Individual Tax Reporting Number if they have one), a valid address and phone number, and an initial deposit.

Your new debit card will typically arrive in 5-7 business days. If requested, your PIN is mailed separately from the debit card and both are mailed to the address on file. You can activate your debit card through our Mobile Banking App, at any Santander ATM, with a branch teller, or by calling 877-726-0631.

You may fund your account with a check or by depositing cash. Speak to a banker about the different ways to fund your account.

For determining the availability of your deposits, every day is a Business Day except Saturdays, Sundays, and federal holidays. If we receive your deposit prior to the applicable cutoff time on a Business Day, we will consider that day to be the day of the deposit.. The first $275 of all checks you deposit on a Business Day will be available no later than the first Business Day after the Business Day we receive your deposit. The remaining funds will be available no later than the second Business Day after the Business Day we receive your deposit. Our full Funds Availability Policy can be found in the Personal Deposit Account Agreement or on our Funds Availability page.

Yes, you can open a joint account at a Santander Bank branch. To add a joint owner to your existing account, all parties must appear together at a Santander branch and will need to bring the following personal information: vaild address, phone number, Social Security number, both government-issued ID and secondary form of identification.

Santander Mobile Banking App

Learn more about getting started with our highly-rated Mobile Banking App

Read more

Direct Deposit

Learn more about how direct deposit works, and how to set up deposits directly to your checking account.

Read more

Getting Started with Online Banking

If you haven’t enrolled yet, read this easy step-by-step guide to get started.

Read more

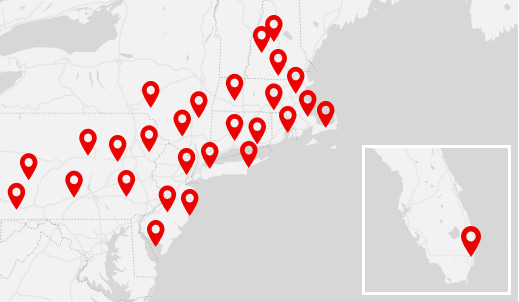

Find Us

Find Us

*$25 Monthly Fee waived when you maintain a minimum combined balance of $25,000 in bank deposits (consumer and certain business products) and eligible investments held with Santander Investment Services. Eligible business products include Business Checking, Savings, Money Market Savings, and Certificates of Deposit accounts, but exclude the following accounts: IOLTA, Bankruptcy, Brokered Deposits, Controlled Disbursement, Escrow, Government, and Union accounts. Eligible investments held with Santander Investment Services do not include the following: Annuities held at Mass Mutual, Allstate, Phoenix, Ohio National; Immediate annuities or annuities that have become annuitized; Mutual funds and 529 products not custodied by Pershing LLC or National Financial Services LLC; Insurance products (With the exception of certain annuities held directly with a product sponsor).

†For detailed information, please review the Personal Deposit Account Fee Schedule.

‡Domestic ATMs are ATMs in the 50 United States, the District of Columbia, and Puerto Rico. ATM owner may charge a separate fee.

1See Guide to Benefits that comes with your card.

2With Priority Pass Membership, there is an entry fee per lounge visit.

3You must properly safeguard your PIN and promptly notify us of any unauthorized transactions. Please refer to Your Liability for Unauthorized Transfers section in your Personal Deposit Account Agreement.

**U.S. checking or savings account required to use Zelle®. Transactions between enrolled consumers typically occur in minutes and generally do not incur transaction fees. In order to send payment requests or split payment requests to a U.S. mobile number, the mobile number must already be enrolled with Zelle®. Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

††If you share your device with other individuals, please note any fingerprints or face image stored on your device may be used to log in to the Santander Mobile Banking App and access your account.

‡‡Digital Banking Guarantee: When you use Online Banking, we guarantee that your money is protected against online fraud or losses and that your bills will be paid on time. You are protected against unauthorized online transactions as long as you check your statement and promptly notify us of any unauthorized activity. Refer to your Digital Banking Agreement for details on guarantees and your responsibilities for promptly reporting unauthorized transactions, as well as a list of supported mobile devices.

§§If a transaction causes your account’s balance to be overdrawn by one hundred dollars ($100) or less, we will not assess any Insufficient– Item Paid fee(s) for that item. The amount of the Insufficient Funds – Item Paid Fee and Sustained Overdraft Fee is $15. A Sustained Overdraft Fee applies to accounts overdrawn by any amount (negative balance) for five (5) consecutive Business Days when the overdrawn balance at the end of the first day is more than $100, and is assessed to the account on the sixth (6th) Business Day. Fees may be imposed for covering overdrafts created by check, in-person withdrawal, ATM withdrawal, or other electronic means. Whether overdrafts will be paid is discretionary and we reserve the right not to pay. For example, we typically do not pay overdrafts if your account is overdrawn for an extended period of time or the overdrawn amount is excessive. Any overdrafts that we pay must be promptly repaid by you.

¶¶We limit withdrawals and transfers out of your savings and money market savings accounts. You can withdraw or transfer funds from a savings or money market savings account a total of six (6) times per Service Fee Period (such as by automatic or pre-authorized transfers using telephone, online banking, mobile banking, overdraft protection, payments to third parties, wire transfers, checks, and drafts). If you repeatedly exceed these limits, we may close or convert your account to a checking account, which may be a non-interest-bearing checking account.

Apple, the Apple logo, Apple Pay and Touch are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc., registered in the U.S. and other countries.

§Securities and advisory services are offered through Santander Investment Services, a division of Santander Securities LLC. Santander Securities LLC is a registered broker-dealer, Member FINRA and SIPC and a Registered Investment Adviser. Insurance is offered through Santander Securities LLC or its affiliates. Santander Investment Services is an affiliate of Santander Bank, N.A.

| INVESTMENT AND INSURANCE PRODUCTS ARE: | |||||

| NOT FDIC INSURED | NOT BANK GUARANTEED | MAY LOSE VALUE | |||

| NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY | NOT A BANK DEPOSIT | ||||

Schedule one-on-one time with a banker.

Schedule one-on-one time with a banker. Equal Housing Lender - Member FDIC

Equal Housing Lender - Member FDIC