Certificate of Deposits - Santander

Annual Percentage Yield*

What is a Certificate of Deposit?

A business Certificate of Deposit (CD) is an FDIC insured† promissory note that has a fixed interest rate and fixed date of withdrawal, known as the maturity date.

And because you agree to invest your money for the entire term, Certificates of Deposit generally offer higher interest rates than savings or money market savings accounts.

When to open a business CD

There are a variety of terms and a guaranteed rate of return. Consider opening a business CD if:

- You need to save for business goals

- You have capital that you don’t plan to use anytime soon

- You need a low-risk way to invest your business savings

What to know before choosing a business CD

When picking a term, make sure you can commit to it. Penalties will apply if you withdraw the money before the end of the CD term.

The interest you earn can be credited to your CD account or transferred to your business checking, savings, or money market savings account. Alternatively, you can also have your interest mailed to you by check.

Schedule one-on-one time with a banker.

Schedule one-on-one time with a banker.

Current Rates

|

CD Term

|

Annual Percentage Yield*

|

|---|

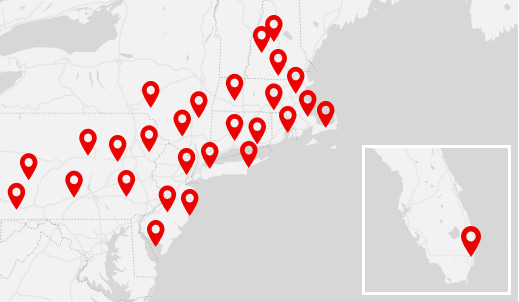

Find

Us

Find

Us

†There is a maximum of $250,000 of deposit insurance from the FDIC for each category of account ownership. Please visit fdic.gov for details.

‡To use the Business Banking App, you must first enroll and log in to Business Online Banking and accept the Business Online Banking Agreement. Message and data rates may apply.

Apple, the Apple logo, Apple Pay and Touch are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc., registered in the U.S. and other countries.

Equal Housing Lender - Member FDIC

Equal Housing Lender - Member FDIC